Updated on January 30th, 2025

For many, pursuing higher education is a pathway to achieving dreams, but the costs associated with tuition, textbooks, and other academic necessities can be overwhelming. What if there were ways to ease the financial burden while staying on track toward academic success? The good news is that opportunities exist for students and their families to reclaim some of those hard-earned dollars. By making strategic decisions and understanding available benefits, managing educational expenses can feel a lot less daunting.

If your student is looking for scholarships to make their college education more affordable, we can help! Sign up for our free college scholarship webinar to learn more about the scholarship process! Take a quick trip over to http://thescholarshipsystem.com/freewebinar to reserve a spot today.

One of the most powerful tools for saving money is knowing how to take advantage of tax deductions for education expenses. These deductions can open doors to significant financial relief, helping students stretch their budgets further while continuing to invest in their future. Whether enrolled in a degree program or taking professional development courses, finding ways to maximize these savings can make a meaningful difference in balancing education and finances.

Contents

- 1 Understanding Qualified Education Expenses

- 2

- 3 Tax Credits for Education Expenses

- 4 Deductions for Education Expenses

- 5 Tax Forms and Documentation

- 6 Special Considerations for Parents and Dependents

- 7 Maximizing Your Education Tax Savings

- 8 Common Mistakes to Avoid

- 9 Education Tax Savings Strategies

- 10 Year-End Tax Planning for Education Expenses

Understanding Qualified Education Expenses

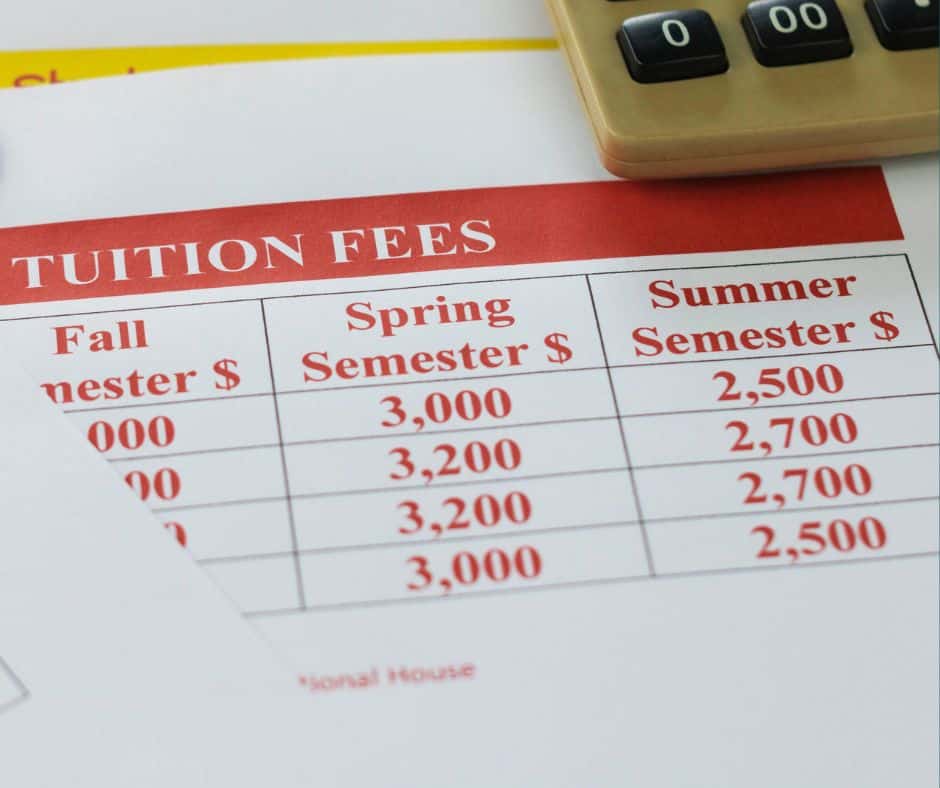

Qualified education expenses are those costs directly tied to attending a higher education program, such as college tuition, mandatory fees, and required course materials. These expenses are essential for enrollment or attendance at an eligible institution, making them a key factor in determining certain tax benefits.

However, it’s important to note that not all costs associated with education fall into this category. Expenses like room and board, insurance, and medical costs are typically excluded, even if they are necessary for a student’s overall well-being.

The Internal Revenue Service (IRS) sets specific guidelines to define what qualifies as an education expense. Payments made through various methods – whether by cash, check, credit or debit card, or even student loans – can be considered eligible under these rules as long as they are directed toward qualified costs. Understanding these distinctions can help students and families make informed financial decisions and take full advantage of available opportunities to offset the cost of higher education.

Tax Credits for Education Expenses

Tax credits offer an excellent way to ease the financial strain of higher education by reducing the amount of taxes owed or even increasing potential refunds. One of the most beneficial options is the American Opportunity Tax Credit (AOTC), which provides up to $2,500 per eligible student annually.

What makes the AOTC credit particularly appealing is its refundable nature, meaning that even if a student’s tax liability drops to zero, a portion of the credit may still result in a refund. It’s designed to help students in the early years of post-secondary education, making it an invaluable resource for those working toward their academic goals.

Another valuable option is the Lifetime Learning Credit (LLC), which offers up to $2,000 per tax return for qualifying expenses. Unlike the AOTC, the LLC is a nonrefundable tax credit, meaning it can reduce the amount of taxes owed but won’t generate a refund.

However, the flexibility of the LLC is a significant advantage, as it applies to a broader range of education levels and programs, from undergraduate studies to professional certifications. Both credits can be claimed for qualifying expenses such as tuition and required fees or similar related expenses allowed by the Internal Revenue Service, making them powerful tools for students looking to make higher education more affordable.

Deductions for Education Expenses

The student loan interest deduction offers relief to graduates and their families by reducing the financial burden of repaying student loans. This deduction allows eligible taxpayers to deduct up to $2,500 of the interest paid on student loans during the year, helping to lower taxable income and making repayment a bit more manageable. It applies to interest paid on loans used for qualified education expenses, providing a valuable benefit for those working to balance the costs of higher education with other financial responsibilities.

For self-employed individuals, certain education expenses may also be tax deductible as business expenses on Schedule C, provided they are directly tied to a trade or business. For example, costs associated with training or coursework that maintains or improves skills essential to a profession can qualify as deductible work-related education expenses. These provisions allow students pursuing additional education to advance their careers or enhance their professional expertise to reduce their overall tax burden while investing in their future success.

Tax Forms and Documentation

Proper documentation is essential for claiming education-related tax benefits, as it ensures compliance with IRS requirements and helps students maximize their potential savings. This includes keeping receipts and records for every qualified education expense.

Form 1098-T is a critical document that reports tuition and other eligible payments made to an educational institution. This form provides key information for claiming credits or deductions, such as the fees deduction for eligible students in previous tax years. Similarly, Form 1098-E reports student loan interest paid during the tax year, which may qualify for deductions, reducing the overall cost of pursuing higher education.

Students should keep thorough records of all qualified college expenses, including payment receipts, account statements, and any other documentation tied to tuition, fees, or course materials. These records are vital for verifying claims of education tax breaks and the associated amounts paid if requested by the IRS.

Staying organized and retaining this paperwork ensures students have the evidence needed to confidently claim the benefits they are entitled to while navigating the financial aspects of their educational journey.

Special Considerations for Parents and Dependents

Parents play a significant role in helping students navigate education-related tax benefits, especially when they claim students as dependents on their tax returns. Parents may qualify for education tax credits or deductions, such as the American Opportunity Tax Credit or the Lifetime Learning Credit, for eligible dependents.

For students not listed as dependents on anyone else’s return, the opportunity to claim credits themselves opens up. However, it’s essential to understand the Internal Revenue Service guidelines surrounding qualified higher education expenses, as these rules determine which costs are eligible for tax benefits.

Income eligibility is another crucial factor to consider, as income limits can affect the ability to claim certain tax credits or deductions. For example, parents and students alike should verify whether they meet the requirements to take advantage of options like the tuition and fees deduction, which, while no longer available for recent years, could still impact earlier filings if applicable.

Additionally, understanding what expenses are tax deductible ensures that families and students make the most of the benefits available while staying within IRS regulations. This careful planning can make education costs more manageable for everyone involved.

Maximizing Your Education Tax Savings

Maximizing education-related tax savings starts with understanding the available credits and deductions that can ease the financial strain of attending undergraduate or graduate school. Students may benefit from the American Opportunity Tax Credit (AOTC) or the Lifetime Learning Credit (LLC), both of which offer substantial savings for qualified education expenses.

For those repaying student loans, the ability to deduct interest paid can provide further relief by lowering taxable income. These options not only reduce a tax bill but also help students keep more money in their pockets for other academic or personal needs.

Staying organized is key to making the most of these opportunities. Students should maintain detailed records of their expenses, such as tuition payments, required course materials, and related fees, to ensure eligibility when claiming credits or deductions.

Consulting a tax professional is another smart step, as they can help identify additional opportunities to deduct education expenses and navigate complex rules surrounding income tax. This proactive approach ensures that students and families take full advantage of every available benefit to make higher education more affordable.

Common Mistakes to Avoid

Avoiding common mistakes is essential to fully benefit from education-related tax savings. One frequent error is failing to keep proper documentation for every qualified education expense, like tuition and fees, which can lead to denied claims during an audit.

Students should also ensure they only claim an education credit or deduction for qualified expenses, as including non-eligible costs could result in penalties. Additionally, meeting the modified adjusted gross income (MAGI) limits is critical, as exceeding these thresholds can disqualify students or their families from claiming valuable tax benefits.

Overlooking opportunities to deduct education expenses, such as the student loan interest deduction, is another mistake that can leave savings untapped, making careful planning and attention to detail crucial.

Education Tax Savings Strategies

Strategic planning can make a significant difference in maximizing education-related tax savings. Budgeting for college tuition and other qualified costs well in advance allows students and families to take advantage of available credits and deductions.

Using a tax-advantaged 529 savings plan can also help cover qualified education expenses paid while offering potential tax benefits. To avoid missing out on opportunities, students should ensure that eligible expenses, such as tuition and fees, are appropriately documented and only include costs that are tax deductible.

Year-End Tax Planning for Education Expenses

Year-end tax planning is an excellent opportunity for students and families to ensure they’ve taken full advantage of education-related savings. Reviewing expenses like college tuition and other qualified costs can help identify opportunities to claim credits or deductions before the year ends.

Making an extra payment on a qualified student loan before December 31 could also allow students to claim the student loan interest deduction, providing immediate financial relief. Keeping accurate records of all expenses ensures that claims are correctly documented and eligible for additional tax breaks, making it easier to reduce the overall financial burden of higher education.

If your student is looking for scholarships to make their college education more affordable, we can help! Sign up for our free college scholarship webinar to learn more about the scholarship process! Take a quick trip over to http://thescholarshipsystem.com/freewebinar to reserve a spot today.

Leave a Reply