Updated on May 20th, 2024

Do you know how to pay for college? Are you fully prepared to cover the substantial expense of college?

Do you want a better understanding of FAFSA, financial aid, scholarships, student loans, and all those key terms for paying for college?

And for those with students already in college, are you paying for college in the most effective way (i.e. zero interest!)?

There are many things to consider when deciding how to pay for college but the most important thing is that you know all your options and exhaust every single one BEFORE taking out student loans (yes, there are other ways to pay than student loans, I promise!).

In this complete reference guide on how to pay for college, I will cover all your options so that you know you are helping your child make the right decision (or as a student, helping yourself).

WARNING: This is a comprehensive guide that will give you exactly what you need to know. Be prepared to bookmark and share this so you can come back to it in the future!

Contents

- 1 What will you learn from this post?

- 2 How much does college truly cost?

- 3 How to pay for college

- 4 Step 1: Influence your bill amount.

- 5 Step 2: Understand that there are alternatives to student loan debt.

- 6 Step 3: Find that free money!

- 7 1. Grants

- 8 2. Scholarships & Cash Awards

- 9 3. Working

- 10 Step 4 (If you must): Borrow student loans as a last-case scenario

- 11 Summary

What will you learn from this post?

- The true cost of college (and how to reduce it)

- Free money available through FAFSA or other sources & how to get it

- Not-so-free money available through FAFSA or other sources (and how to limit the amount of interest you have to pay)

How much does college truly cost?

For most parents, sending a child off to college is an enormous investment, second only to your mortgage. For students, this is most likely the largest expense you have yet to take on.

So how can you pay for it without tapping into a retirement account or signing up for a life of student loan payments?

First, let’s just address the elephant in the room. College is freaking expensive. And it isn’t going to get any cheaper. Banks are basically giving out mortgages to 18-year-olds so why would any university lower their prices?

Yes, this reality stinks. Fortunately, while it may not be at the same rate as college costs, the amount of scholarships and other forms of financial aid are increasing as well. But I am getting ahead of myself.

Let’s take a look at just how expensive college is.

The dollar values are based on the average cost of ONE YEAR at a public 4-year university (which means 4 years = $94,996). If your child goes private or needs to stay around for an extra semester or year, you will most likely be in the 6-figures.

And because of these enormous costs, students are graduating with more debt than ever.

How to pay for college

In the rest of this post, I am going to cover exactly where you can find money to pay for college.

Step 1: Influence your bill amount.

The first step to paying for college is actually cutting the amount you have to pay in the first place. I always tell my students to come up with a plan, some sort of budget, and stick to it. Then they can find different ways to reduce spending.

We decided to make it easy for you and share some of our tips on how to reduce these costs. They are conveniently placed in the infographic above for you (I know, pretty easy, right?). Feel free to pin it by clicking here so you don’t forget these tips.

We actually created a Paying for College series to help you reduce the college bill.

Related posts on how to reduce your child’s college bill:

- Paying for College Part 1: Reducing College Tuition Costs

- Paying for College Part 2: Reducing Your Tuition Bill (continued)

Step 2: Understand that there are alternatives to student loan debt.

The next step to paying for college is understanding that there ARE alternatives to student loans. Before I get into them, here are some quick stats on it.

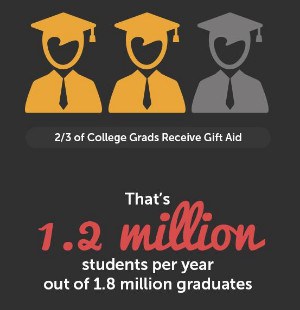

Free money is actually not that rare. The majority of full-time students receive some sort of financial aid (whether scholarships, grants, cash awards, etc.).

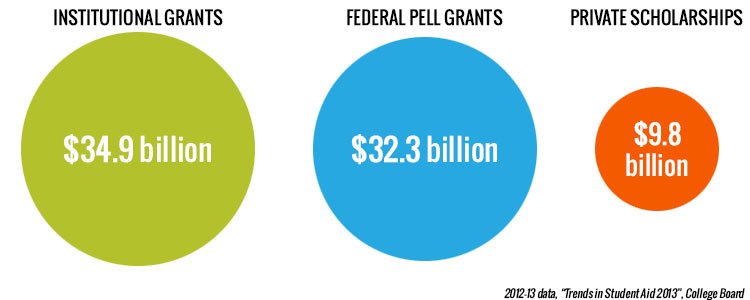

Students received a total of $123.8 billion in scholarships and grants. About 37% of this free money comes from the federal government and, to qualify, you need to fill out the FAFSA. Here’s a breakdown of where grant money comes from:

- Federal

- College

- Private

- State

— College Board

Source: https://bigfuture.collegeboard.org/pay-for-college/grants-and-scholarships/the-basics-on-grants-and-scholarships

In fact, here’s a great stat shared by College Raptor, showing that millions of students receive some sort of financial aid.

So no matter what doom and gloom story you are told, there is money out there.

Step 3: Find that free money!

Now let’s take a look at these crazy terms: Grants, FAFSA, Financial Aid, Scholarships, Cash Awards, Student loans, and other forms of funding so that you can help your student work their way to a debt-free degree.

1. Grants

Grants provide free money that never has to be paid back. Most grants can be accessed by submitting FAFSA and are first-come, first-serve so make sure you submit your FAFSA as soon as possible (I’ll tell you how to do that in just a moment).

The U.S. Department of Education offers a variety of federal grants to students attending four-year colleges or universities, community colleges, and career schools.

Here are the official pages of each one:

- Federal Pell Grants

- Federal Supplemental Educational Opportunity Grants (FSEOG)

- Teacher Education Assistance for College and Higher Education (TEACH) Grants

- Iraq and Afghanistan Service Grants

Speaking of FAFSA, here are the details you need to know.

Now I mentioned FAFSA quite a few times so let’s talk about why it’s so important and what you need to know in order to complete it.

FAFSA stands for Free Application for Federal Student Aid and can be submitted at https://studentaid.gov/fafsa-app/ROLES.

The reason this is so important is that it gives students access to grants as well as lower-interest student loans. All families should submit FAFSA no matter what. It will never harm you if you do submit one but not submitting it could mean your family misses out on thousands of dollars!

The deadline to submit your FAFSA is June 30, 2021, although you want to submit it as soon as possible (as in the next couple of months at most). The funding is first-come, first-serve so the sooner the better.

So how do we submit the FAFSA?

Below is a great list shared by Bankrate on what you need in order to complete the FAFSA.

Once you go through the process the first time (about 30 minutes if you have all your materials ready), it will be faster and faster each year.

Did I just say each year?

Yep.

FAFSA has to be resubmitted every single year.

You can submit it as early as October the year before and you get to use the previous year’s tax return so this should get even easier on families.

FAFSA doesn’t only help secure students grants. There are other forms of funding that can come from it which I will share with you in just a moment.

2. Scholarships & Cash Awards

Many people think these things are mystical creatures that don’t really exist.

I have great news: scholarships are very real, and they are here to help you!

|

Scholarships and Cash Awards are also forms of free money that do not have to be paid back. The difference is that these come from all over the place – your university, associations, organizations, your state government, your child’s favorite restaurant, you name it.

While “only” 13% of financial aid given comes from private scholarships, that still equates to over $9.8 BILLION. That’s a lot of money, and it is increasing every year.

The best part is that nearly any student can find scholarships they are eligible for, including yours, even if you aren’t low-income, your student doesn’t have a perfect GPA, and they are the furthest thing from a superstar athlete (ask my mom how athletic I was and you’ll understand).

And I can speak from experience, especially on this one. I was able to secure a completely free ride through scholarships and funding, completely paying for my college education including studying abroad for 6 months. I say that not to brag but to show you that IT’S POSSIBLE!

You may have also noticed I said ‘Cash Awards’.

These are the same exact process as scholarships except that the money goes directly to your student immediately upon winning rather than to the Bursar’s Office for the following semester. These are more common for upperclassmen in college because they are more based on achievements in college. I also cover these in the webinar if you want to join us.

3. Working

While this isn’t free money, hard-earned money is better than money that charges you interest.

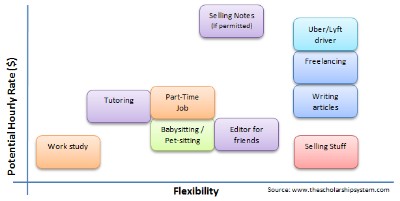

Having your student work part-time has tons of benefits including better time management, a greater appreciation for money, increased awareness of finances, and a stronger resume for post-graduation jobs, but of course one of the biggest benefits is that a part-time job can largely decrease the amount your student needs to borrow.

Want some ideas? Keep reading. You can also check out this quick post:

- Related post on making money in college: PAYING FOR COLLEGE PART 5: MAKING MONEY WITH FLEXIBLE JOBS

““The National Center for Education Statistics (NCES), which is run by the U.S. Department of Education, found that students working 1-15 hours weekly have a significantly higher GPA than both students working 16 or more hours and students who don’t work at all.” ”

Source: BYU Study

Here are some common and some not-so-common, creative ways your student can bring in money:

- Work-study – An option to work for reduced tuition or hourly pay. Offered via FAFSA, this is actually relatively rare to receive and you should always make sure the hourly payout is equal to or higher than any other job option.

- Hourly job – Does your student want flexible hours? Have them try serving. Want time to do homework? Try a front desk position.

- Tutoring

- Selling notes*Please confirm it is not against your University policy before doing so. This varies from school to school.

- Babysitting or Dog/Pet-sitting

- Selling old stuff (and this means cleaning their closet back home!)

- Uber/Lyft driver (if they have their car on campus though I don’t recommend that to freshman)

- Editor for friends

- Freelance work online

- Write articles for online publication

Step 4 (If you must): Borrow student loans as a last-case scenario

One last tip on how to pay for college is regarding student loans. As a parent, it can be very difficult to pay for all of college. This may mean your student has to take out some student loans.

If they do, the best thing you can do is to make sure they are taking out the right loans, that is, the loans that will cost them the least.

There are two main categories of student loans:

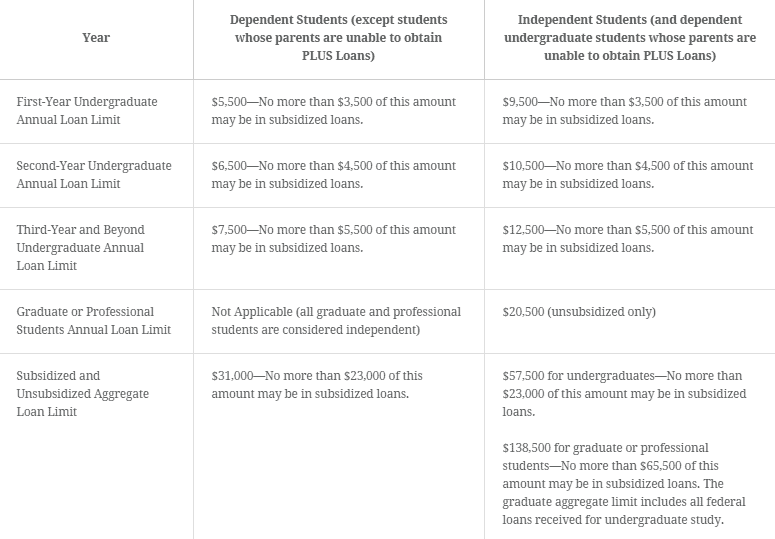

Subsidized loans – This is where the government pays the interest while your student is in college which means your child can save tens of thousands of dollars over their 4 years in school. Subsidized loans are offered through the FAFSA (I told you the FAFSA is important!)

Unsubsidized loans – Interest starts accruing as soon as the money is borrowed. This means that your child will start building up interest in their freshman year. It is then rolled into the final loan amount once they graduate and they are then charged interest ON THEIR INTEREST. Crazy. These can be found via FAFSA as well as typical lending institutions. Nearly always, federal loans (FAFSA) will have lower interest rates than private loans.

As mentioned, FAFSA offers many different avenues for funding, one of which is loans. Below is a table from https://studentaid.gov/ describing borrowing limits of the loans they offer.

Student Loan Limits via FAFSA

Overall, the best thing to do with loans is to calculate what the total life of the loan will cost your student and only borrow what is truly needed.

It’s easy to take out $5,000 here, $10,000 there but have your student calculate the amount they will actually have to pay back (including interest) before they sign anything. It can be eye-opening.

Summary

Understanding all your options for paying for college can change your child’s future. By knowing all your options, you can limit (or completely eliminate) the amount of student loans your child will have to borrow, saving you (and them) tens of thousands of dollars.

Which college funding methods do you use or plan to use, after reading this post?

What have I missed in this post? I’d love to hear from you!

If you want to join us for the live webinar we mentioned earlier on scholarships and college funding, grab your spot at thescholarshipsystem.com/freewebinar.

Sources:

Image of percentage that receive financial aid & breakdown of financial aid sources by percentage: https://bigfuture.collegeboard.org/pay-for-college/grants-and-scholarships/the-basics-on-grants-and-scholarships

Chart showing debt per student:

http://blogs.wsj.com/economics/2015/05/08/congratulations-class-of-2015-youre-the-most-indebted-ever-for-now/

Graphic on number of students with financial aid: https://thescholarshipsystem.com/wp-content/uploads/2016/01/scholarship-graphic.jpg

FAFSA Grants: https://studentaid.ed.gov/sa/types/grants-scholarships

FAFSA list of documents: http://www.bankrate.com/finance/college-finance/make-most-of-fafsa-application.aspx

BYU Study on working in college: https://thescholarshipsystem.com/wp-content/uploads/2016/01/effects_of_student_employment.pdf

Want help finding scholarships? Sign up for our Free webinar here.

Related Videos:

If your student is trying to avoid debt, scholarships are a great option. They can cover a range of college costs and don’t have to be paid back. If you and your student want to learn about scholarships, sign up for our free college scholarship webinar! Take a quick trip over to http://thescholarshipsystem.com/freewebinar to reserve a spot today.

Unfortunately I’m going to have to take out private loans cause I’m a rising college freshman and am having FAFSA-related issues so I’m not allowed access to whatever financial aid (whether scholarships, grants or federal loans) I may have been awarded, if any. The only money I’ve received in scholarships or cash awards is $250. And I have to pay at least part of tuition by the beginning of August at the very latest if not by July 1. ??