Updated on May 20th, 2024

When your student is preparing to head to college, the expected family contribution (EFC) on their FAFSA plays a big role in the kind and amount of financial aid they may receive to attend college. If your student isn’t ready to complete their FAFSA, then using an EFC calculator can help them get an estimate of what other need based aid may be available.

In most cases, using an EFC calculator is fairly easy, as long as your student has access to the right information. If they want to use one of these handy tools, here’s what they need to know.

You should always try to find scholarships to help cover the bill. If you want to learn how I secured 6-figures in scholarships and graduated completely debt-free, join me for my next free online training: www.thescholarshipsystem.com/freewebinarpst.

Contents

What is a FAFSA EFC Calculator?

Typically, an EFC calculator is technically an EFC estimator.

After your student puts in the relevant details, the calculator approximates the expected family contribution, giving your student a valuable guideline that can help with college planning.

While many reputable calculators are reasonably reliable, the results aren’t guaranteed. Your student could input their FAFSA information and receive a different official than the calculator gave. However, if your student was fairly accurate with the data when using the EFC estimator, the difference should be minor if one does occur.

Is the EFC Calculator Quick?

If your student has the necessary information ready, using a FAFSA EFC calculator is a fast process. But, just as with completing the actual FAFSA, it can take some time to gather any required documents to ensure an accurate estimate.

What Information Do You Need to Use an EFC Estimator?

While your student can make their best guess when putting information into a FAFSA EFC calculator, hard numbers are going to yield more accurate results.

Ideally, your student should gather the following documents before using an EFC estimator:

- Tax Returns

- Bank Statements

- Investment Statements (non-retirement accounts)

- Business Statements (if either parent or the student owns a business)

Which FAFSA EFC Calculator Should I Use?

There are a surprising number of FAFSA EFC estimators available, but they might not all be accurate or even safe. Some are associated with for-profit businesses and may serve as an attempt to gather personal information about your student and family or as a selling platform for private student loans.

However, some are highly accurate and secure and won’t be used to collect personal information for later use or as an attempt to sell.

If your student is primarily focused on learning about what they may receive in federal financial aid, then he or she should start with the FAFSA4caster from the US Department of Education.

How to Complete the FAFSA4caster

The FAFSA4caster is an incredibly simple option for learning about EFC financial aid possibilities before your student actually submits their FAFSA.

Once they access the calculator, they need to answer a few questions about themselves. This includes:

- Citizenship

- Birth Date

- Marital Status

- College Student Status

Then, they review a few statements and check those that apply.

Next, is a section covering information about you. Your student will need to provide details on:

- Parents’ Marital Status

- Parents’ Ages

- Parents’ Household Size

- Number of College Students in Parents’ Household

After those questions, is a brief section on the student’s parent’s income. Ideally, your student should refer to a recent tax return to confirm their parents’ adjusted gross income.

Additionally, they should review the assets estimate and make changes (using the bank and investment statements as guides) if necessary. Then, they need to select their parents’ state of residence.

Finally, your student provides similar financial information about themselves, their financial situation, including any income, assets, and their state of residence.

Once complete, your student simply clicks submit to move forward.

On the next screen, your student has the option to enter in information about the college they are interested in attending. If they choose to do so, they will receive a semi-detailed breakdown of how any federal financial aid package will apply to their cost of attending college.

However, your student can still review their eligibility without any school information into the FAFSA EFC calculator.

Related Articles:

- Complete Step-by-Step Guide on FAFSA & How to Get the Most Financial Aid

- The Complete Reference Guide on How to Pay for College: FAFSA, Financial Aid, Scholarships, Student Loans and More

What Do the FAFSA4caster EFC Financial Aid Results Mean?

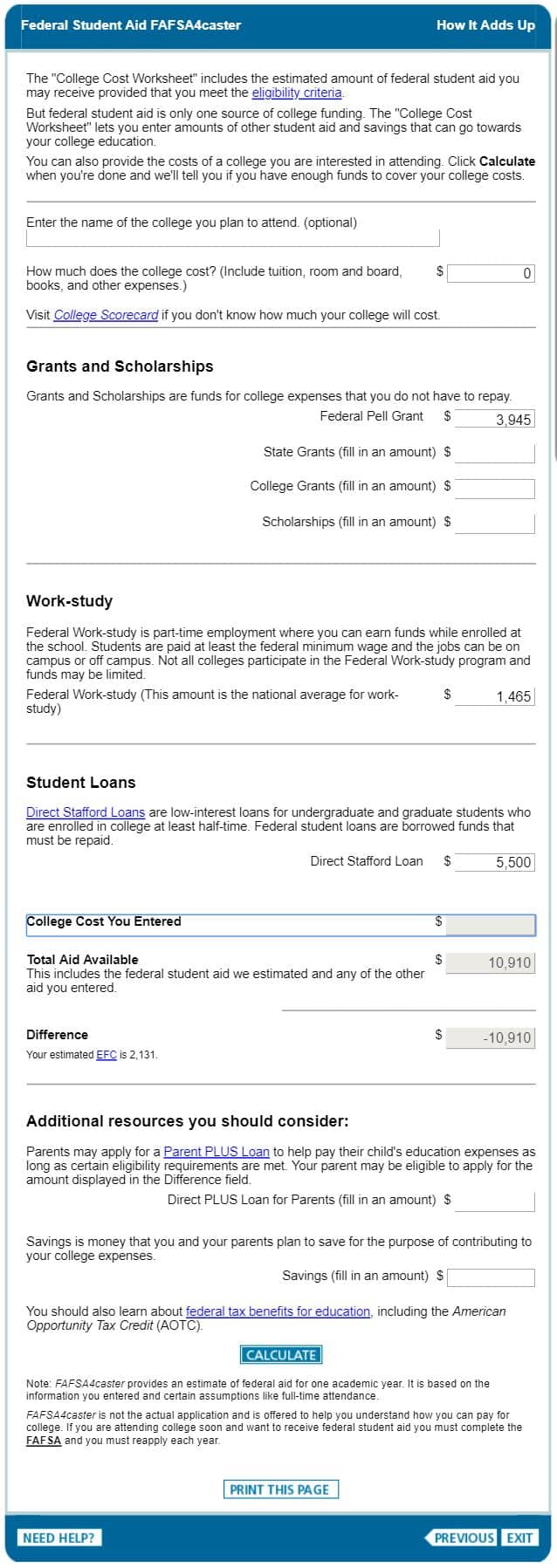

On the results page, your student will see multiple sections that show how much they may receive in federal aid.

The first section, labeled Grants and Scholarships, shows your student whether they will qualify for EFC financial aid in the form of the Federal Pell Grant as well as the amount of aid they might receive.

In the Work-study section, your student will see if they may qualify for the work-study program and the amount they might be able to earn in one of these paid part-time positions.

Finally, the Student Loans section displays the amount in Direct Stafford Loans (the student loans backed by the federal government) your student could potentially receive to help pay for school.

There are other blanks in this form that can function as a secondary calculator, allowing your student to see how much federal financial aid they could receive depending on the cost of attendance at their preferred college, the amount they are receiving in other grants and scholarships, as well as if savings or a Direct PLUS Loan for Parents will help cover their college costs.

What Does the EFC Code Mean?

In the Difference section of the calculator, there is a line that shows your students estimated EFC. Depending on the information given, that number can range from EFC 0 (or EFC 00000) to a maximum EFC of 999,999.

Now, those numbers are NOT necessarily a reflection of the amount a household is expected to contribute to a student’s education. Instead, these numbers are a score. The lower the score, the more federal aid a student can typically receive.

EFC 0 is the lowest and usually denotes that the expected family contribution is essentially $0. EFC 999,999 is the highest and generally means that a student will not have access to options like the Federal Pell Grant, though may be able to use federal student loans and/or work-study, depending on certain other factors.

How Does EFC Affect the FAFSA Award Letter?

Once your student completes their FAFSA, that information (including their EFC code) is sent to the schools they select. Each college then uses that information to estimate how much your student will receive in federal student aid, and complete the remainder of their financial aid package with that factored into their offer.

Effectively, the EFC tells the college how much a student could potentially afford to contribute toward their education while also filling them in on how much financial aid the federal government is willing to provide. Then, the school can compare those amounts to the cost of tuition, room and board, and similar expenses to determine if your student may qualify for additional institutional aid, such as grants or scholarships from the college.

After they complete their calculations, your student will receive a financial aid and FAFSA award letter from the school that outlines what is available. Your student can then determine if that meets their financial needs and whether they want to accept and formally enroll in that college.

However, not every school follows the EFC to the letter. Some provide educational options for students that don’t require them to use student loans, for example, even if they are eligible for them based on their FAFSA. You can read more about those schools here: Colleges That Meet 100% Financial Need Without Student Loans

Ultimately, a FAFSA EFC calculator gives your student a chance to view their expected family contribution and potential federal financial aid options before actually completing their FAFSA. The results can be valuable from a planning perspective, particularly if your student is trying to figure out which schools may be affordable to them.

What to do if the FAFSA Award Letter Isn’t Enough?

If your family receives the financial aid letter and there is a large gap, there are a few steps you can take.

First, you may want to reconsider universities. Finding a more affordable school is one of the easiest ways to keep college costs and bring down the amount your student has to borrow in student loans.

Next, you may want to try negotiating with the school which we cover in-depth here: 5 Steps to Negotiate College Tuition and Save Thousands of Dollars

Lastly, you should always try to find scholarships to help cover the bill. If you want to learn how I secured 6-figures in scholarships and graduated completely debt-free, join me for my next free online training: www.thescholarshipsystem.com/freewebinarpst.

>>Join our Free Training on the 6 Steps to Securing Scholarships here.

Can’t make the next training? Come back when you have time! We hold them regularly!

Leave a Reply